Home Insurance Cost Calculator

This home insurance calculator is used by mortgage loan officers and real estate professional helping customers understand the cost of homeownership. After comparing the cost and features of 129 policies offered by 52 insurers, canstar presented us with the national award for outstanding value home & contents insurance for the fourth year in a row in 2020.

for a school project i need to calculate how much my

for a school project i need to calculate how much my

Well, weve got something better.

Home insurance cost calculator. Is $1,633, but insurance companies will consider multiple factors when calculating your homeowners insurance rates, including:. A home insurance cost calculator will determine how much coverage you should opt for when you are insuring your home. According to the national association of insurance commissioners, home insurance rates are up almost 47% in the last 10 years alone.to help you understand the market, we did some digging to discover which states are the most and least expensive.

Average home insurance cost by state. Your home insurance rate will be lower if you choose a high deductible. Free online home replacement cost calculator.

The cost of insuring a home has continued to rise steadily throughout the country. How your homeowners insurance rates are calculated. Homeowners in states that are prone to hurricanes, hail storms, tornadoes and earthquakes tend to pay the most for home insurance.

All of these factors affect the decision what level of home insurance coverage you will need, and how much it will ultimately cost you. A basic home insurance calculator includes the age of your home, the methods used in its construction, area considerations such as weather and crime rates. When you have replacement cost coverage, the limit of insurance on your home reflects the cost to rebuild your home if it were to be totally destroyed.

A calculator is a rough estimator of home insurance payments. The amount you insure your home for, or sum insured, should reflect the total cost of rebuilding your home.theres a lot to consider when calculating this value including building materials, foundations, interiors, outbuildings and your homes surrounds. Based on a home with $300,000 in dwelling coverage, $300,000 in liability coverage and a $1,000 deductible, the top 10 most expensive home insurance markets include:

The douglas residential cost guide utilizes the compilation of actual residential construction costs, the use of various estimates for residential occupancies and other construction cost sources from across canada for home insurance calculation purposes.the online home replacement cost calculator employs the same techniques for calculating the. Going with a higher deductible will save you money. If you want a rough estimate of what house insurance rates in manitoba are like, a calculator can help, but it wont be as accurate as a tool that captures all of the factors that influence your premiums, such as where you live, what it costs to rebuild your.

To start tell us a bit about the property type of house. In 2019, the average cost to construct a home was $115 per square foot, according to the national association of home builders. By insuring it at the replacement cost, your insurance company will pay its full replacement value rather than the depreciated amount.

Insurers ask for a sum insured which is the highest amount that will be paid out if a house is damaged beyond repair. Youll need to be comfortable the estimate reflects the actual replacement cost of your buildings as it doesnt take into consideration specific circumstances which may. The deductible your share of the repair cost when you file a claim.

Your home could be underinsured for its true rebuild cost. This cost can be significantly different than the market value of your home. Get a quote once you have the costs worked out call us on 0800 500 216 , or get a quote online.

To work out your rebuild cost, use the house insurance calculator or contact a professional. Insure too high, and you are overpaying on your insurance policy. This is a free home insurance calculator with no personal info needed.

While many factors go into calculating your rate, where you live is chief among them. Our calculator uses the average building cost in your area to determine how much it would take to rebuild your home. Estimating the rebuild cost of your home is essential for house insurance policies.

Your email has been submitted. The home insurance calculator is designed to estimate the valuation of a residential property and can also be used as a landlord insurance calculator. Simply enter your zip code and the square footage of your home, click the calculate button and we will give you an estimate of your replacement cost.

How much does house insurance cost? To get an estimate of how much it would cost to replace your building and/or contents, use our quick and easy calculators below. Home insurance calculator estimate homeowners insurance coverages and limits to best protect your home.

The national average is $95.51 per square foot, but costs in your area could vary greatly from that amount. You can use the building insurance calculator to estimate out how much it would cost to rebuild your home. Insure for too low, and you could be out of pocket.

The cost of combined home insurance fluctuates across the country, averaging at 146 per year according to moneysupermarket data from march 2020. If you have a $500 deductible, you're going to pay more on your premiums than if you have a $2,000 deductible. But while where you live is a factor in how much you can expect to pay for your home insurance, there are plenty of other reasons for this disparity in costs.

Chances are you came to this page in search of a home insurance calculator for manitoba, canada. The average annual cost of homeowners insurance in the u.s. It will also reduce your home insurance claims.

Use our home insurance coverage calculator to help choose the right coverages and policy limits for you. Replacement cost calculations are based on square footage and other building features. Using the free rebuild calculator i was able to adjust this to ensure my property is covered fully.

The price of a homeowners policy is based on many factors, but the amount your home is insured for is an important one. Because of this, you can calculate the replacement cost of your home. It is not a professional valuation.

Quickly calculate coverage limits for a homeowners policy, including dwelling, personal property, and liability coverage. Homeowners insurance cost is a combination of several factors. By using lowestrates.cas home insurance calculator, your annual insurance bill could be reduced by hundreds of dollars, because youll be able to see if theres an insurance company that can offer the coverage you need for a lower price.

Our home insurance calculator will quickly give you an estimate of how much dwelling coverage you should carry to fully protect your home. The estimate will be a guide only. My home insurance policy was only covering 80% of it's rebuild cost.

Cost of Commuting Calculator />

Cost of Commuting Calculator />

(2014) National Renovation & Insurance Repair Estimator

(2014) National Renovation & Insurance Repair Estimator

Shifting to your new home? "Will my insurance go up if I

Shifting to your new home? "Will my insurance go up if I

Mortgage Prequalification Calculator How Much House Can

Mortgage Prequalification Calculator How Much House Can

How Much House Can I Afford Mortgage rates, Buying first

How Much House Can I Afford Mortgage rates, Buying first

Home Collection Loan Easy Way To Get Cash In Trouble

Home Collection Loan Easy Way To Get Cash In Trouble

What Every Home Buyer Needs To Know About Closing Costs

What Every Home Buyer Needs To Know About Closing Costs

Do You Need Title Insurance When Buying a Home? Title

Do You Need Title Insurance When Buying a Home? Title

Fast and free offers for homeowner insurance homeowner

Fast and free offers for homeowner insurance homeowner

Life with a mortgage (is surprisingly sweet) Mortgage

Life with a mortgage (is surprisingly sweet) Mortgage

Mortgage Affordability Calculator How Much House Can I

Mortgage Affordability Calculator How Much House Can I

How to refinance your mortgage Refinance mortgage

How to refinance your mortgage Refinance mortgage

How much are closing costs for the seller Opendoor in

How much are closing costs for the seller Opendoor in

The best states for an early retirement Health insurance

The best states for an early retirement Health insurance

4 Tups to avoid Refinance scams! Refinance mortgage

4 Tups to avoid Refinance scams! Refinance mortgage

Mortgage Savings Calculator to Calculate MidTerm

Mortgage Savings Calculator to Calculate MidTerm

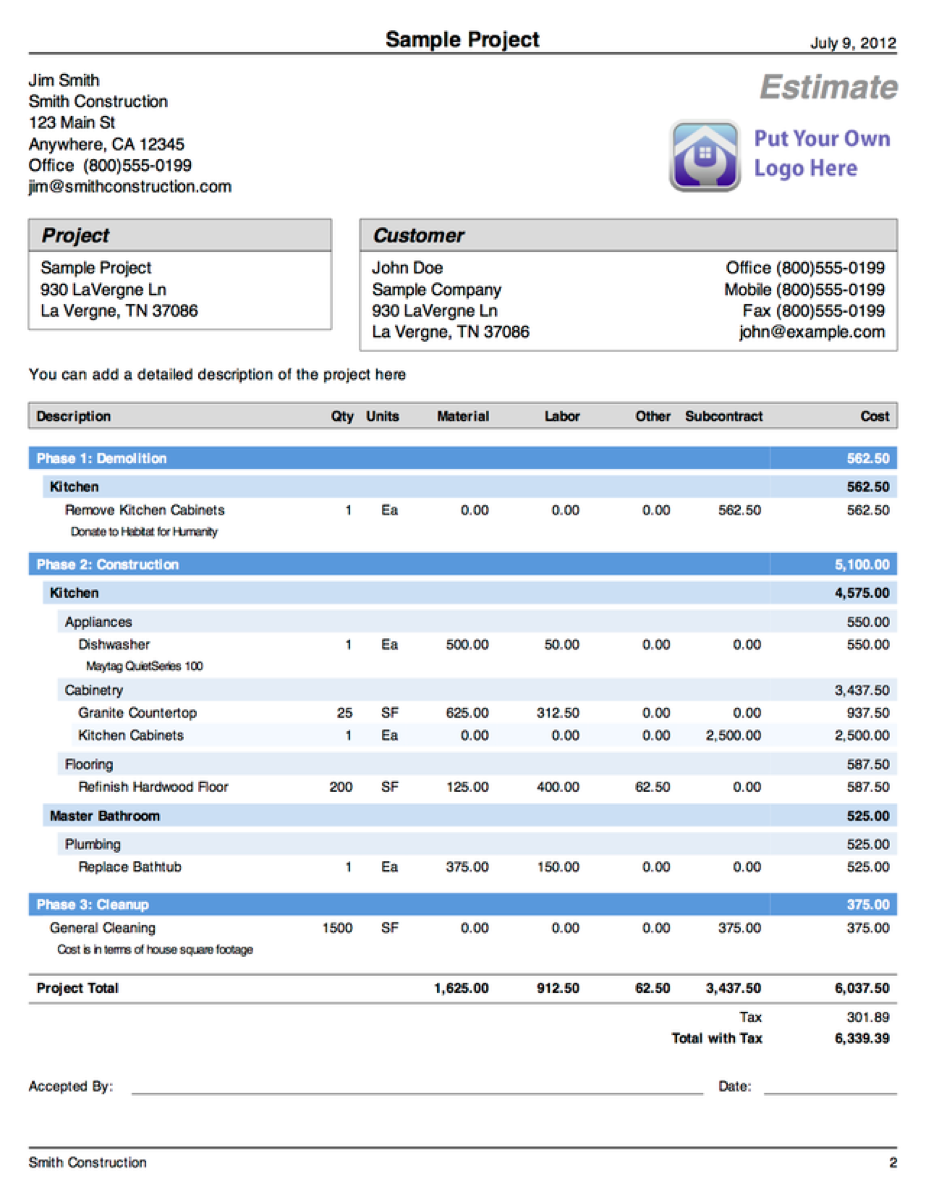

2019 Kitchen Remodel Estimate Best Interior House Paint

2019 Kitchen Remodel Estimate Best Interior House Paint

Florida Seller Closing Costs & Title insurance calculator

Florida Seller Closing Costs & Title insurance calculator

Cheap insurance rates Home loans, Mortgage loan

Cheap insurance rates Home loans, Mortgage loan